Continuity Planning is a process that ensures that in the event of bad health or death, an individual or family or business is able to carry on with minimal financial and structural disruption. If the proper plans are in place, it will also lessen the emotional impact of death or poor health. Most of us have a great deal of control over our life and have plans and contingency plans in place to make sure we achieve our goals. But there is one thing over which we have no control – health. Of course exercise and eating well helps, but it’s no guarantee of perfect health. Proper Contingency Planning involves implementing insurance in order to create financial security. But it also means having other tools and techniques ready in the event of a medical surprise.

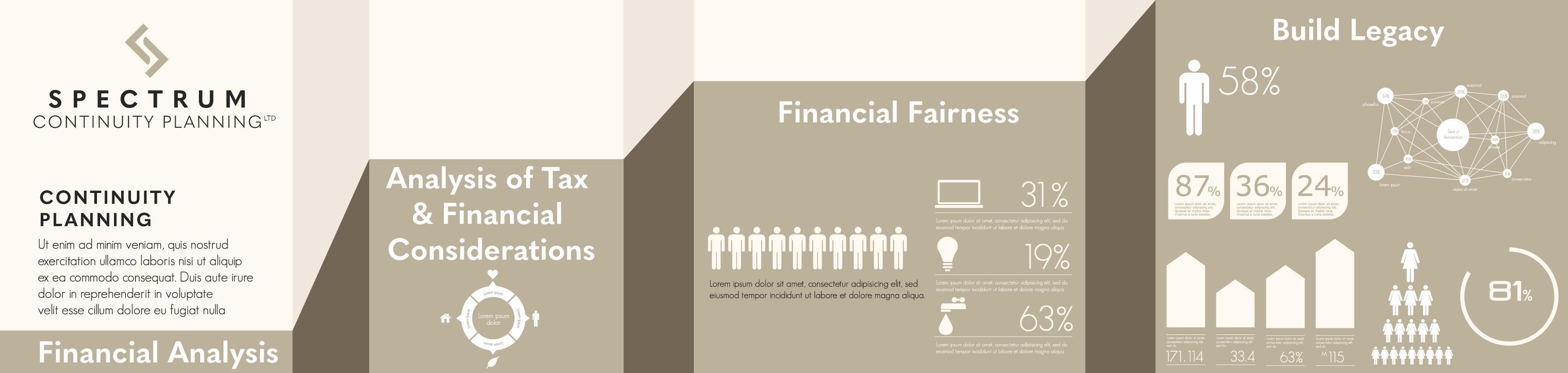

INFORMATION GATHERING: The first step in Continuity Planning is to gather “hard” facts and examine the current position. What do you owe? What do you own? What is your income? How much do you spend? But more important are the “soft” facts. What are your plans? Where are you going with your life? What do you want for your family or business?

ANALYSIS OF FINANCIAL INFORMATION AND OPTIONS: Next is to examine specific financial outcomes in the event of bad health or death. A valuable technique at this stage is to “crash-test” your financial position in the event of bad health or death.

FINANCIAL FAIRNESS: The hard numbers tell a story. But you probably want the outcome of your plans to be “fair”? “Fair” means something different to each of us. What is fair for other family members if one family member is sick or dies? What is fair to other shareholders in a business? What is fair to employees?

BUILD A LEGACY: You will die one day, and be remembered. You have choice over how you will be remembered. Or, you might be disabled or sick one day, and you will watch and co-exist with your loved ones dealing with the financial legacy of your disability planning.

IMPLEMENT: After knowing where you stand financially, and what you want for people in your life, you can finance your wishes with insurance. As well, you can ensure continuity and minimal disruption with proper documentation and legal agreements.